Bespoke wealth management solutions

Boasting a global presence and a commitment to quality products and services, Falcon Private Bank offers the best in bespoke wealth management solutions

A bespoke wealth management solution is by no means a catch-all fix, but rather seeks to accommodate a very specific set of requirements laid out by a client. So often, firms sticking to an off-the-peg investment strategy fail to yield the returns they perhaps otherwise could if they were to adopt a more personalised approach, and this in essence has given rise to a huge subsector of tailor-made solutions in the wealth management industry.

A bespoke wealth management solution is by no means a catch-all fix, but rather seeks to accommodate a very specific set

of requirements

The fundamental difference between standardised and bespoke wealth management solutions is that the client’s preferences are considered on a continual basis, as opposed to their being allocated a model based on a simple risk profile at the beginning. It stands to reason that each client has his or her own personal preferences when it comes to how they wish to spread their wealth, and bespoke wealth management solutions offer a service whereby individual expectations are factored into the decision-making process.

For all intents and purposes, a bespoke wealth management solution takes the place of a financial advisor, with added involvement, with the participating firm working alongside the client at all times in deciding upon the best course of investment. The idea could not be further from the packaged investment models that have for too long dominated the industry, and it would appear that bespoke wealth management solutions have gathered steam over the past few years as investors have grown increasingly cautious of how their wealth is spread.

The investment climate can be a tricky field to navigate for newcomers, especially those who wish to hone in on any one particular goal. Therefore, bespoke wealth management solutions, while infinitely different in their makeup, boast a real mass-market appeal.

The wealth management industry

Packaged and bespoke wealth management solutions, while fundamentally different in theory, are not necessarily all that easy to differentiate between in practice. The market for bespoke wealth management services has grown substantially over the last few years, with a sliding scale of individualised product offerings.

[O]thers see wealth management as a matter of matching their investment appetite, values and philosophy with a

particular firm

What’s more, the ever-present air of mistrust has served to obscure clients from arriving at the level of customisation they require when making complex investment decisions, which again has stifled the industry’s fastest-growing subsector.

Although many investors are keen to offload their savings and have a firm take full responsibility for them, others see wealth management as a matter of matching their investment appetite, values and philosophy with a particular firm. Therefore a degree of transparency and accountability is now more important to the wealth management industry than it has ever been before.

As opposed to a financial advisor, wealth managers assume a far more hands on position with regards to how a client’s capital is spread, so a level of trust between both parties is essential if the relationship is to prove a fruitful one.

Falcon Private Bank

One institution whose bespoke wealth management solutions represent the utmost in personalisation and client-centricity is Falcon Private Bank. The Zurich-based firm specialises primarily in personalised wealth management solutions for high net worth clients, families and institutional investors.

A view over Zurich at night: Falcon Private Bank’s headquarters are based in the Swiss city

“Our discerning clientele values quality advice, products, management and processes,” writes the bank. “We place particular emphasis on protecting the privacy of our clients and the assets they entrust us with.”

We place particular emphasis on protecting the privacy of our clients and the assets they entrust us with

Falcon Private Bank is perhaps best known for its offering of bespoke solutions. Together with an experienced financial advisor, clients are asked to specify their risk capacity and appetite, along with the various ways in which they wish their assets to be spread, in formulating a tailored investment strategy based on the latest financial market research and metrics.

Strategic considerations include precise investment guidelines, classes and sectors, and the portfolio manager will monitor the fund’s performance on a continuous basis in order to yield the best returns possible for the client. What’s more, the actual allocation of the assets will vary over time with respect to ever-changing market conditions, while never straying from the parameters specified by the client.

Falcon Private Bank’s comprehensive processes and systems here make for a suitably client-orientated product, and, what’s more, ensures that the firm stays true to its claim of bespoke wealth management solutions.

Below: World Finance speaks to Nick McCall, CEO of Falcon Private Bank, to find out about the bank’s bespoke wealth management solutions

Philosophy and values

Falcon Private Bank’s personalised approach, Swiss banking expertise, and commitment to results are what makes its services stand out to clients globally

Falcon private Bank’s expertise in the Swiss private banking arena stretches back almost 50 years to 1965, during which time it has succeeded in cementing a strong financial base and comprehensive global presence on which to build for the future.

Falcon Private Bank represents the benchmark to which all aspiring wealth management firms should aim for

The bank’s core values are threefold, these being expertise, security and global presence, which have together led Falcon Private Bank to the level of renown it enjoys today, most notably in the field of bespoke wealth management solutions. Since the bank’s beginnings, it has partaken in a distinguished Swiss tradition of wealth management and committed to delivering first-rate products and services to distinguished clients across the globe, and it will no doubt continue to do so for some time yet.

“Our personalised approach, combined with Swiss banking expertise, experience and commitment results in the creation of long-term and successful client relationships based on trust, confidentiality and respect,” says the bank’s CEO Eduardo Leemann.

Falcon Private Bank’s philosophy is perhaps best reflected in its approach to investment, in that the firm promises sustained growth and cautious risk assessment to deliver on value preservation and strong performance. Always dedicated to good governance, as well as accountability and responsibility to stakeholders, Falcon Private Bank represents the benchmark to which all aspiring wealth management firms should aim for.

A global influence

As well as the firm’s head office in Zurich, Falcon Private Bank has branches and representative offices in Abu Dhabi (pictured), Geneva, London, Hong Kong and Singapore

The bank currently employs more than 300 staff, who are based at the firm’s head office in Zurich as well as its branches and representative offices in Geneva, London, Abu Dhabi, Dubai, Hong Kong and Singapore.

[T]he firm’s geographic distribution is very much representative of the way in which the wealth management industry is growing at present

Falcon Private Bank is also unique in the sense that it is a Swiss banking institution with roots in the Middle East. Since April 2009, the firm has been wholly owned by Aabar Investments PJS, which has in turn landed the bank with a wealth of additional expertise in regards to Middle Eastern markets. The bank’s beginnings in the region stretch even further, however, to 2008, at which time the firm extended its presence to Dubai, and later opened a representative office in Abu Dhabi in 2011.

What’s more, the firm’s geographic distribution is very much representative of the way in which the wealth management industry is growing at present. And while Switzerland has for some time ranked as one of the wealth management industry’s foremost locations, recent advances in Asian markets look soon to become equally as valuable in terms of growth opportunities.

Although lesser-developed markets, such as those in Asia, still have to cover some distance before they catch up with the formidable European market for bespoke wealth management solutions, Falcon Private Bank is well positioned to capitalise on these opportunities once they come to fruition.

Worldwide activities

Aside from the firm’s impressive bespoke wealth management solutions, Falcon Private Bank has also partaken in a number of events and initiatives across the globe.

Falcon Private Bank has also partaken in a number of events and initiatives across the globe

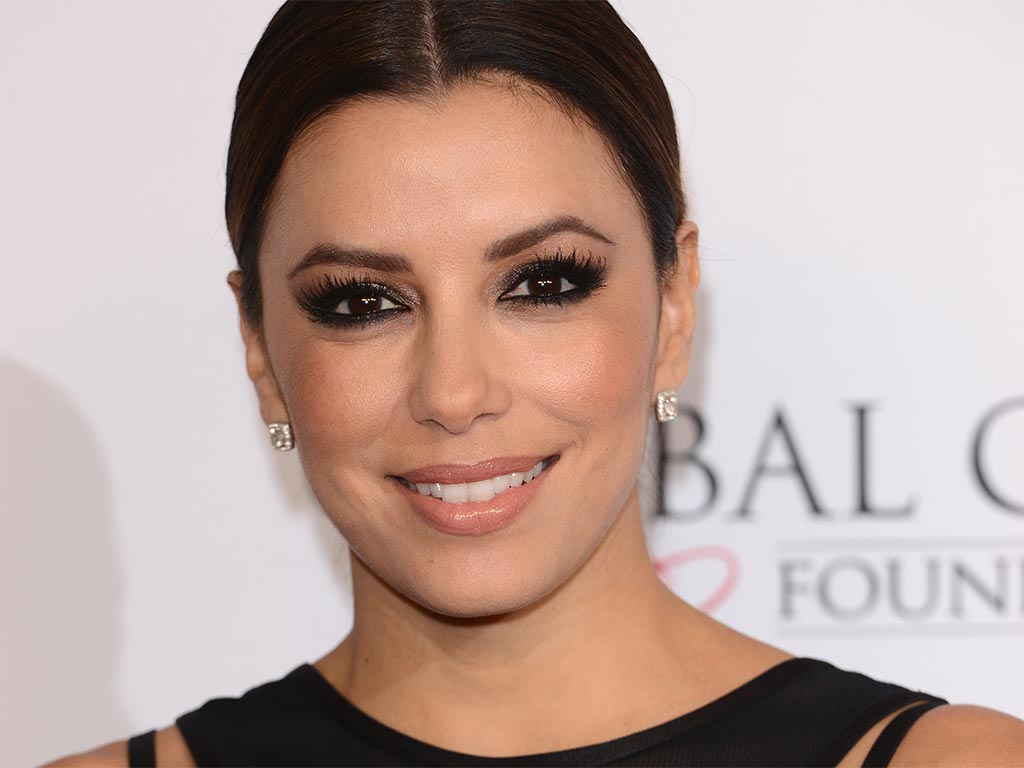

In the latter stages of 2013, the bank acted as an official partner for the first annual Global Gift Gala in Dubai, a unique international fundraising initiative that forms part of the Global Gift Foundation. Chaired by actress, activist and philanthropist Eva Longoria, the event raised funds for the support and medical care of vulnerable groups in locally affected areas.

Eva Longoria chaired the first annual Global Gift Gala in Dubai. Falcon Private Bank was an official partner for the event

“The markets we operate in are so diverse and with our strong presence in the region, we are delighted to support handpicked local philanthropic initiatives that make a real difference”, said Zafar Khan, CEO of the MENA Region for Falcon Private Bank.

Elsewhere, the bank has engaged in a number of non-banking initiatives in Russia, not least of which being a partnership with Garage Centre for Contemporary Culture, which coincided with a new art exhibition entitled ‘Personal Choice’.

The bank’s commitment to activities outside of wealth management is in keeping with Falcon Private Bank’s core philosophy in that it represents a continued commitment to its many stakeholders wherever they may be.